We provide greater access to credit, capital, and entrepreneurship for underserved communities nationwide.

NOVAE.

Since 2014.

Financial Technology

Financial Inclusion

Financial Education

Financial Empowerment

|

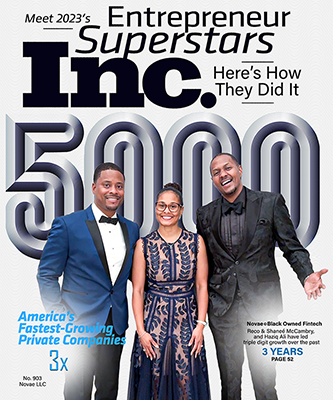

Inc. 5000 list of America's Fastest-Growing Private Companies THREE YEARS IN A ROW! 2021, 2022, and 2023! |

"Novae is helping business owners establish business credit scores then leveraging the scores to access cash and credit."

"Inc Magazine announced this week that Novae, LLC has been named one of Inc. 5000's fastest-growing companies for a third year running, reaching number 903 on the list."

"Black-owned fintech Novae LLC has announced the launch of a new online tool designed to help small businesses find grants and tax incentives that can help them to grow exponentially."

ABC's "Shark Tank" investor and FUBU Founder & CEO Daymond John congratulates Novae's founders and affiliates on their Inc. 5000 recognition!

Play Video

Novae provides greater access to credit, capital and entrepreneurship for underserved communities nationwide.

CREDIT BUILDING

Personal and Business credit education, technology, and services to improve credit scores to access capital, save money, and become more financially stable.

For Consumers For Businesses

ACCESS TO CAPITAL

Fintech platforms providing access to multiple lenders for personal loans and business funding, in addition to government grants, tax credits, and guarantees.

Personal Loans Business Funding

DEBT HELP

Exclusive partnerships with licensed debt restructuring firms for consumers and small businesses, reducing their debts and payments up to 90% in some cases.

For Consumers For Businesses

ENTREPRENEURSHIP

Providing services to help entrepreneurs start, grow, and scale their businesses, in addition to offering channel partnerships to leverage Novae's fintech platform.

Get Business Services Join Affiliate ProgramConsumer financial products leading to a better life. See if you qualify today.

Affordable Life Insurance Policy

A few simple questions let’s our carriers provide you quotes for different coverage options.

We are currently enhancing the Life Insurance program and it is not available for new enrollments at this time.

The Novae Family

Right now is a great time to join our growing Novae family. Become an affiliate, start your own white label or inquire about opportunities with our corporate office.

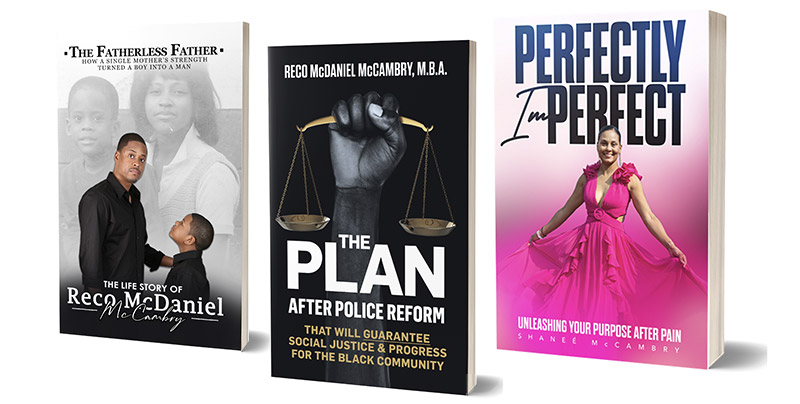

Inspiring Books Written by Novae's CEO and COO...

Novae's leadership goes beyond offering financial services to create positive change. They openly share their own life experiences to tackle important issues and provide step-by-step solutions that empower anyone to build a successful life.

Novae donates a percentage of it’s revenue to support underserved communities across the country!

We prioritize supporting education initiatives, displaced families, our elderly communities, feeding the hungry, and clothing the needy.

For more information or to donate to Novae Cares click below!

Novae donates a percentage of it’s revenue to support underserved communities across the country!

We prioritize supporting education initiatives, displaced families, our elderly communities, feeding the hungry, and clothing the needy.

For more information or to donate to Novae Cares click below!

Novae is a proud member of the Direct Selling Association and a Signatory of the DSA Code of Ethics. To file a business complaint, email This email address is being protected from spambots. You need JavaScript enabled to view it..

Novae is a fintech company that provides greater access to credit, capital, and entrepreneurship for consumers and small businesses nationwide, with a particular interest in empowering underserved communities, driving financial inclusion! Founded in 2014, we serve clients across all 50 states, including Puerto Rico.

Novae, LLC

1506 Klondike Road Ste 403

Conyers, GA 30094

Phone: (678) 750-3787

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

1506 Klondike Road Ste 403

Conyers, GA 30094

Phone: (678) 750-3787

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

For Consumers

For Entrepreneurship

For Small Business

More about Novae

Novae is a fintech company that provides greater access to credit, capital, and entrepreneurship for consumers and small businesses nationwide, with a particular interest in empowering underserved communities, driving financial inclusion! Founded in 2014, we serve clients across all 50 states, including Puerto Rico.

Novae, LLC

1506 Klondike Road Ste 403

Conyers, GA 30094

Phone: (678) 750-3787

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

1506 Klondike Road Ste 403

Conyers, GA 30094

Phone: (678) 750-3787

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

We offer the following services

For Consumers

For Entrepreneurship

For Small Business

More about Novae

© Novae - All Rights Reserved

© Novae - All Rights Reserved