BUSINESS CREDIT BUILDER PROGRAM

"Unlock the hidden path to maximize funding for your business!"

Key Benefits:

Understand & improve fundability of your business

Establish & utilize tiers of business credit

Secure new business loans & credit lines

How Fundability WORKS to Prepare Your Business for Funding and Growth … in 5 Simple Steps

Step 1

Know Your Fundability Score™ and Unlock Funding Now

Step 2

Identify Fundability Factors™ Holding You Back From Growth

Discover what’s holding you back from maximum Fundability and quickly eliminate these barriers including business structure, financials, and industry risk to secure maximum capital.

HINT: Over 125 hidden factors can block your approvals—Fundability® reveals them to you … and helps you fix them fast!

Step 3

Track Your Business Bureau Insights™

Step 4

Maximize Your Fundability®

Step 5

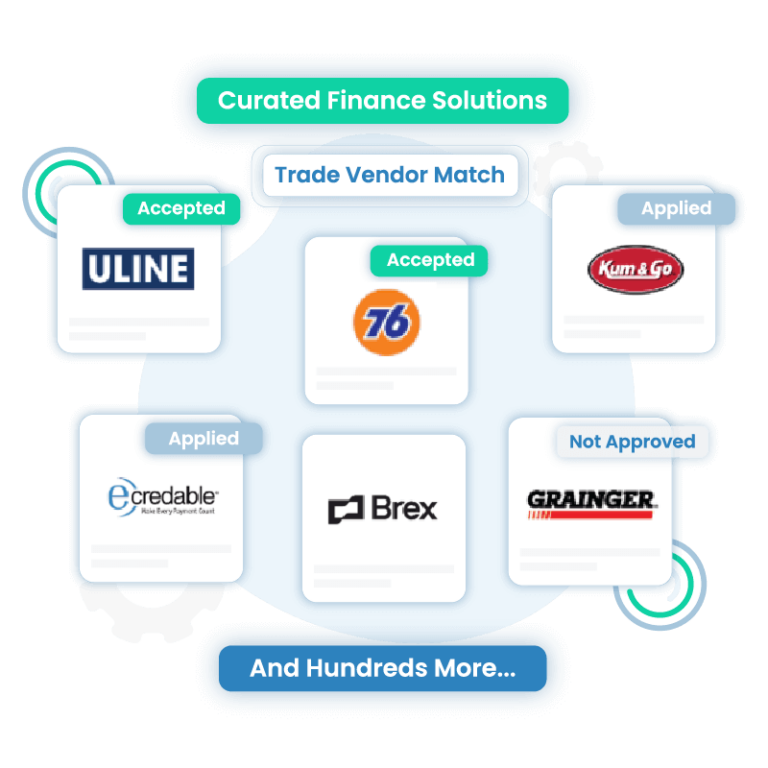

Get MATCHED With Vendors, Lenders and Credit Issuers

Fundability matches you with both secured and unsecured credit lines, vendor accounts and even business financing based purely on the strength of your company’s creditworthiness … without relying on personal credit or personal guarantees.

With exclusive access to a database of over 300+ vendors, suppliers, lenders, and credit issuers, you’ll be able to build strong business credit FASTER with companies that actually report to the business credit bureaus.

We'll assist you with accessing credit lines with limits ranging from...

$5,000 to

$150,000!

STOP Waiting! See What’s Holding You Back and Get the Capital You Deserve!

Watch the Business Credit Finance Suite walkthrough

With our intuitive software and dedicated full-service business credit adviser team, we streamline the process of securing business credit, guiding you effortlessly at every step.

What's included in our program?

| PRODUCT/SERVICE FEATURE | VALUE |

|---|---|

Business Credit Finance Suite | $2,500 |

Business Credit Education & Restoration | $2,500 |

Personal Business Coaching & Advisement (12 mos) | $2,400 |

Access to Lending Sources in Specific Tiers | $2,000 |

myNovaeDisputes Manager (12 mos) | $800 |

Experian Smart Business Monitoring data | $600 |

Personal Debt & Budgeting Software | $240 |

THE TRUE VALUE OF THIS SYSTEM | $11,040 |

The Success of Your Business | PRICELESS! |

$2,495

Questions? Speak with an Expert.

Don’t need everything included above?

D.I.Y. Business Credit Finance Suite

$995 one-time

Included with your D.I.Y. Program purchase:

- Business Credit Builder D.I.Y.

- Personal Credit D.I.Y. Kit

- Access to ALL of the same Business Credit Tiers and information

- Funding Specialist Team

Testimonials

What our clients are saying about the Business Credit Builder program

My financial consultant walked me through all the funding that my business could get approved for. I was able to obtain my $50,000 within 3 to 4 months

- Brian

This has been a lifesaver on all levels. Getting my LLC up and running, having advisors there to call when I need them.

- Michelle

The good thing about having a business credit profile is that she was able to apply for some business funding without even using her social security number.

I cannot tell you how excited, how happy I am that we found this solution. The only problem you're going to have, is that you did not find this sooner.

- Edward A.

The business finance suite has opened up possibilities for my business in the future that I never could have imagined.

- Cheryl

It's been everything it was advertised to be and then some. I'm not sure where you can find a program that is as comprehensive.

- Curtis H.

The business finance suite is an extraordinary product for business owners. It allows business owners to do two things - it allows them to build credit for their business, and get money.

- Brian H

The team is very supportive, very knowledgable about business credit and securing the best financial options for you, and they go through everything thoroughly.

- Jim

Learn From Our Business Credit Expert

Fundability® helps you build business credit faster, secure maximum funding, access capital at lower rates and better terms, and even connects you with over 300+ funding sources—all in one easy-to-use platform.

Go ahead ... see how it works!

Ready to get started?

Frequently asked questions

A personal guarantee is an individual’s legal promise to repay credit issued to a business where they are an owner, executive, or a partner.

With business credit agreements, giving a personal guarantee essentially makes you a co-signer on the business credit account. You will remain liable for any debts the business incurs. You have given a “personal guarantee” that you will be responsible for the debt.

In practice, this means that your personal credit will undergo a hard inquiry, since you are putting your Social Security number on the credit application. With enough hard inquiries, your personal credit score will be adversely affected.

You may be wondering: do business credit inquiries hurt my credit? Unlike with personal credit, anyone can pull your business credit reports. This does result in inquiries.

However, unlike with personal credit, business credit inquiries don't negatively affect your Fundability or business credit scores with each business credit bureau.

Business credit tiers are actually Credit Suite terminology. Our business credit advisors continually check and recheck vendors and other credit and business financing issuers. There are differences in terms of how easy or difficult it is to be accepted for credit, and what you may need to provide to qualify.

For example, business credit tier 1 is vendor credit, where you need very little to get started. You can qualify with few payment experiences on your business credit reports. You may be able to qualify with a short time in business, such as six months. Or you may be able to get around certain more stringent requirements by offering a personal guarantee or making a deposit to secure the credit.

And to get to business credit tier 2, you will need to have at least three trade accounts reporting to the business credit bureaus.

When a lending institution has more than just your personal credit scores to look at, they will review any other information which they believe will better answer their one big question: will you pay them back?

Because it’s possible to have good business credit with bad credit on the personal side. But if your business credit is good enough for a lender, they will weigh it more heavily in their decision.

Lending institutions will let your business credit guide them as they pull your business credit reports and look for a few things.

- Do you pay your bills on time?

- Are there a lot of negative/derogatory items on your credit reports, such as lawsuits or liens?

- How long have you been in business?

- Is the business credible?

- Does the information on the business credit report match the information received on the application?

If the answers to these questions satisfy the lending institution, then you’re more likely to get a loan, although it will not necessarily be for exactly the amount you were originally seeking.

If your business and/or personal credit is already in good shape OR you have good business revenue ...

1506 Klondike Road Ste 403

Conyers, GA 30094

Phone: (678) 750-3787

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

For Consumers

For Entrepreneurship

For Small Business

More about Novae

1506 Klondike Road Ste 403

Conyers, GA 30094

Phone: (678) 750-3787

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.