Novae Tax Pro Software & Co-Brand

The Fastest Way To Launch A High-Profit Tax Business

-

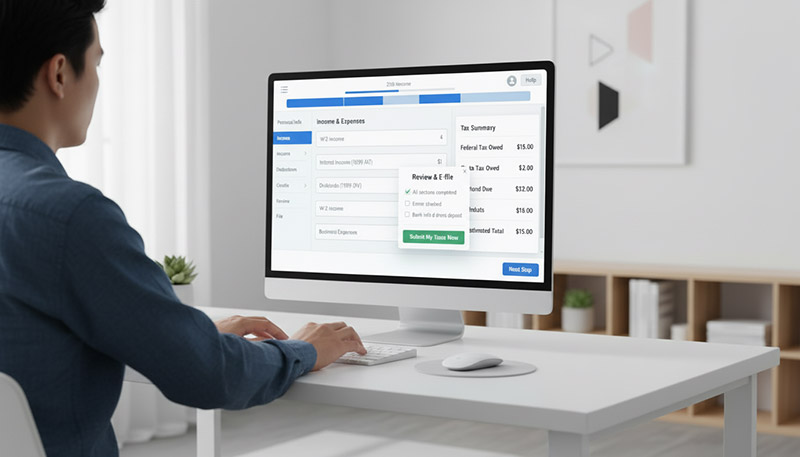

Professional Software

-

Full Support

-

Instant Credibility

Why Serious Tax Professionals Partner With Novae

You get:

- A nationally recognized fintech company behind your business

- A platform proven since 2014

- Technology, training, and support built to help you win

This is not a hype operation or a personality-driven brand. You are partnering with a company on the Inc. 5000 list, a member of the Direct Selling Association, and a trusted financial services provider with thousands of reviews.

You are not just buying software. You are buying certainty.

What Novae Tax Software Actually Gives You

Novae Tax Software gives you everything

The Four Essentials

- Professional Software - Your choice of top-tier platforms like OLT or TaxSlayer for individual and business returns

- Clear Training - Step-by-step onboarding and ongoing mentorship from 6- and 7-figure tax professionals

- A Credible Brand - White label branding to elevate your image instantly (Included with PLUS)

- Year-Round Revenue Options - Complete financial services platform beyond tax season (Included with PLUS)

Novae handles the heavy lifting so you can focus on serving clients and earning income.

Why Novae Beats Every Other Tax Software Offer

Respectful, Permission‑Based Communication

Company Strength That Elevates YOUR Brand

Receive Education Before Expectation

Novae Tax Pro Software Co-Brand PLUS

Your Complete Year-Round Revenue Solution

Here's the problem most tax professionals face: You're working 3-4 months a year. Making good money during tax season. Then watching it dry up the other 8-9 months.

You know you need year-round revenue. You know you should offer financial services. But building a website, finding partners, integrating systems... that's a $10,000+ project and 6 months of headaches you don't have time for.

Novae Tax Pro Software Co-Brand PLUS solves this.

You get professional tax software, a fully built financial services platform, and 50/50 revenue share on backend service-fees. Everything you need to turn your seasonal tax business into year-round revenue.

This is your branded financial services platform. Tax prep is the front door. Credit building resources, business funding, debt relief, high-yield accounts... that's where the year-round revenue comes from.

Total Value Breakdown

Novae Tax Pro Software

Federal & state returns, individual & business filing, unlimited e-filing

Novae Tax Pro Co-Brand

Personal & business loans, credit building, debt relief, high-yield accounts, and more

50/50 Revenue Share on backend service-fees

Turn tax clients into year-round revenue

| Novae Tax Pro Software: | $1,495 |

| Novae Tax Pro Co-Brand: | $2,499 |

| Market Value: | $3,994 |

| Your Price: | $1,499 |

| You Save: | $2,495 |

You get professional-grade tax software, a fully built financial services platform, and revenue share. Without spending $10,000+ and 6 months building it yourself.

What's Included

1. Novae Tax Pro Software

- Your choice between 2 top-tier, professional-grade software programs

- Federal & state returns for individuals and businesses

- Unlimited e-filing with integrated bank products

- Ability to offer the tax program to other tax professionals and earn commissions on software and Co-Brand sales

- Multi‑user access for teams

2. Novae Tax Pro Co-Brand

Your complete, turnkey financial services website with built-in services you can offer clients and earn commissions on:

- myNovaeDisputes (AI-powered DIY credit software)

- High-Yield Savings & Checking / Cash Advance options

- Personal & Business Loans

- Business Credit Finance Suite

- Consumer & Business Debt Relief Solutions

- Student Loan & Auto Refinance Programs

- Free LLC Registration service

- Plus over a dozen other financial services directly from your Novae-branded website

3. Revenue Share on Backend Service-Fees

- 50/50 revenue share on backend service-fees

- Turn tax clients into year-round financial service clients

4. White-label Software

- See your brand logo and colors in your tax software

- Allow your PTINs to operate under one unified brand

- Included in pricing if you choose OLT software, additional otherwise

Real Value

- Your brand. Novae's proven fintech system. (Inc. 5000 company)

- Delivered in 2 weeks. No setup work from you.

- Instant credibility with a polished, professional online presence

Unleash Your Full Potential

| Novae Tax Pro Software Basic |

Novae Tax Pro Software Co-Brand+ Best Value |

|---|---|

|

$499

+ $99/mo Affiliate Pro platform fee*

|

$2,499

$1,499

LIMITED TIME OFFER

+ $99/mo Affiliate Pro platform fee*

|

Already have Tax Software?

You Can Still Add Year-Round Revenue!

The stand-alone Novae Tax Pro Co-Brand gives you a fully built financial services website. Ready in 2 weeks. Zero technical work from you.

What The Platform Includes

Year-Round Financial Services You Can Offer Clients

- Personal & Business Loans

- Business Credit Finance Suite

- myNovaeDisputes (AI-powered DIY credit software)

- Consumer & Business Debt Relief Solutions

- High-Yield Savings & Checking / Cash Advance options

- Student Loan & Auto Refinance Programs

- Free LLC Registration service

Complete Turnkey Setup

- Your brand alongside Novae's proven fintech system (Inc. 5000 company)

- Delivered in 2 weeks with no setup work from you

- Instant credibility with a polished, professional online presence

- Turn tax clients into year-round financial service clients

Standalone Co-Brand Platform

Platform only. Tax software and revenue share on backend service-fees not included.

| Co-Brand Platform Value: | $2,499 |

| Your Price: | $999 |

| You Save: | $1,500 |

+ $99/mo Affiliate Pro platform fee*

Want the Complete Package?

Get tax software, the Co-Brand platform, AND 50/50 revenue share on backend service-fees with Novae Tax Pro Software Co-Brand PLUS for $1,499.

Learn More About PLUSWhich Solution Is BEST for Me?

Novae Tax Software Comparison

Choose Your Software, Just $499 | PLUS options are Additional

Click any row for more details

| Feature | TaxSlayer | OLT |

|---|---|---|

| ▶ 1040 Returns | ✅ Full Support | ✅ Full Support |

📋 1040 Individual Tax ReturnsBoth platforms provide comprehensive support for all individual tax returns including all schedules and supporting forms. TaxSlayer:

OLT:

|

||

| ▶ Business Entities | ⚠️ Desktop Only | ✅ Full Support |

🏢 Business Entity Tax ReturnsOLT offers full web-based support for all business entity forms. TaxSlayer has the same forms available via Windows desktop software download. TaxSlayer:

OLT:

|

||

| ▶ Trusts & Estates | ⚠️ Desktop Only | ✅ Full Support |

⚖️ Trusts & EstatesOLT offers full web-based support for trust and estate returns. Personal has the same forms available via Windows desktop software download. TaxSlayer:

OLT (Full Web-Based):

|

||

| ▶ Mobile App for Clients | ✅ Branded App | ❌ Not Available |

📱 Mobile Client AppWhite-label mobile app with your logo and branding - only available in TaxSlayer. TaxSlayer:

OLT:

|

||

| ▶ Spanish Language Support | ✅ Full | ⚠️ Limited |

🌎 Spanish Language SupportFull Spanish capabilities in TaxSlayer platform vs. limited support in OLT. TaxSlayer:

OLT:

|

||

| ▶ K-1 Import & Management | ❌ Not Available | ✅ Included |

📊 K-1 Import & ManagementK-1 forms from partnerships (1065) and S-Corps (1120S) flow to individual returns. OLT can import K-1 data automatically vs. manual entry with TaxSlayer. TaxSlayer:

OLT:

|

||

| ▶ Bulk Processing | ⚠️ Basic | ✅ Advanced |

⚡ Bulk Processing & High-Volume ToolsOLT offers advanced bulk processing tools. TaxSlayer has basic batch e-filing only. TaxSlayer:

OLT:

|

||

| ▶ White Label | Optional Add-on under PLUS | Included in PLUS |

🏷️ Tax Software PLUS: White Label OptionsThe Novae Tax Software PLUS options include the Novae Tax Pro Co-Brand PRO Program ($2,499 value) which helps turns your tax business into a year-round financial services powerhouse with your branding alongside Novae's proven fintech system! PLUS TaxSlayer Pricing:

PLUS OLT Pricing:

Novae Tax Co-Brand PRO Program ($2,499 value) included with both PLUS packages Co-Brand Features (Included with Both PLUS Packages):

|

||

Novae Tax Software Comparison

Choose Your Software, Just $499 - PLUS options are Additional

Click any row for more details

| Feature | TaxSlayer | OLT |

|---|---|---|

| ▶ 1040 Returns | ✅ Full Support | ✅ Full Support |

📋 1040 Individual Tax ReturnsBoth platforms provide comprehensive support for all individual tax returns including all schedules and supporting forms. TaxSlayer:

OLT:

|

||

| ▶ Business Entities | ⚠️ Desktop Only | ✅ Full Support |

🏢 Business Entity Tax ReturnsOLT offers full web-based support for all business entity forms. TaxSlayer has the same forms available via Windows desktop software download. TaxSlayer:

OLT:

|

||

| ▶ Trusts & Estates | ⚠️ Desktop Only | ✅ Full Support |

⚖️ Trusts & EstatesOLT offers full web-based support for trust and estate returns. TaxSlayer has the same forms available via Windows desktop software download. TaxSlayer:

OLT (Full Web-Based):

|

||

| ▶ Mobile App for Clients | ✅ Branded App | ❌ Not Available |

📱 Mobile Client AppWhite-label mobile app with your logo and branding - only available in TaxSlayer. TaxSlayer:

OLT:

|

||

| ▶ Spanish Language Support | ✅ Full | ⚠️ Limited |

🌎 Spanish Language SupportFull Spanish capabilities in TaxSlayer platform vs. limited support in OLT. TaxSlayer:

OLT:

|

||

| ▶ K-1 Import & Management | ❌ Not Available | ✅ Included |

📊 K-1 Import & ManagementK-1 forms from partnerships (1065) and S-Corps (1120S) flow to individual returns. OLT can import K-1 data automatically vs. manual entry with TaxSlayer. TaxSlayer:

OLT:

|

||

| ▶ Bulk Processing | ⚠️ Basic | ✅ Advanced |

⚡ Bulk Processing & High-Volume ToolsOLT offers advanced bulk processing tools. TaxSlayer has basic batch e-filing only. TaxSlayer:

OLT:

|

||

| ▶ White Label | Optional Add-on under PLUS | Included in PLUS |

🏷️ Tax Software PLUS: White Label OptionsThe Novae Tax Software PLUS options include the Novae Tax Pro Co-Brand PRO Program ($2,499 value) which helps turns your tax business into a year-round financial services powerhouse with your branding alongside Novae's proven fintech system! PLUS TaxSlayer Pricing:

PLUS OLT Pricing:

Novae Tax Co-Brand PRO Program ($2,499 value) included with both PLUS packages Co-Brand Features (Included with Both PLUS Packages):

|

||

After your purchase - How It Works

FAQs

To prepare paid returns, you need:

- A valid PTIN (Preparer Tax Identification Number) from the IRS

- An EFIN (Electronic Filing Identification Number) to e-file returns

Optional credentials that may be required depending on your state:

- IRS Annual Filing Season Program completion

- State-specific tax preparer registration or licensing

- Professional certifications (EA, CPA, Attorney) for representing clients

The software itself has no prerequisites for purchase or practice use. However, to legally prepare returns for compensation and electronically file them, you must obtain the proper IRS credentials. We provide full training on the software, tax business operations, and affiliate marketing but credential applications are handled directly with the IRS.

1506 Klondike Road Ste 403

Conyers, GA 30094

Phone: (678) 750-3787

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

For Consumers

For Entrepreneurship

For Small Business

More about Novae

1506 Klondike Road Ste 403

Conyers, GA 30094

Phone: (678) 750-3787

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.